As the Russia-Ukraine war drags on, the market for rare gasses has seen greater volatility. High purity rare gasses used in semiconductor production have seen a rapid price surge, with neon gas prices growing tenfold and krypton gas up by almost half since the conflict.

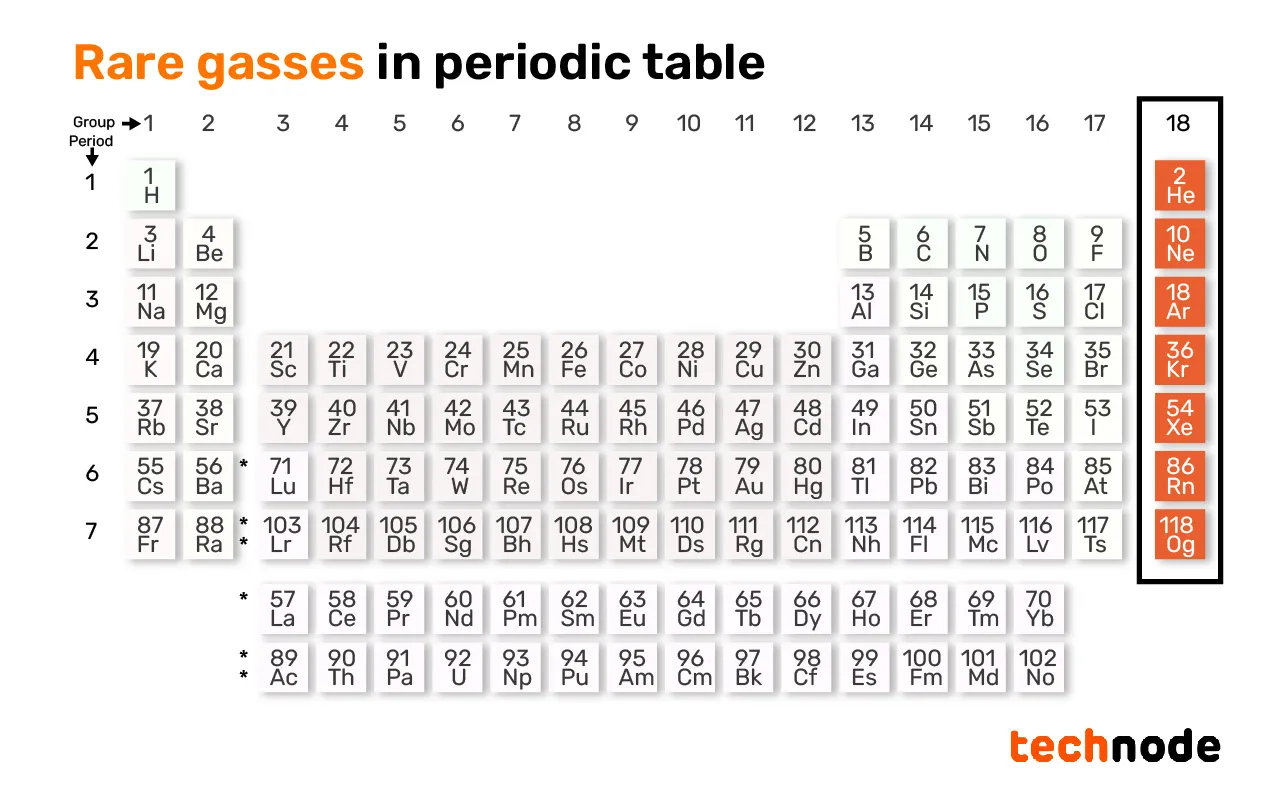

Rare gasses are primarily inert and gaseous elements of neon, argon, krypton, xenon, and others. They are key raw materials used in semiconductor productions.

Until the war broke out in late February, Ukraine supplied nearly 70% of the world’s neon gas, the rare gas used in chip production, according to Trendforce, a semiconductor consultancy based in Taiwan. On March 11, three weeks into the conflict, two major Ukrainian neon gas suppliers, Ingas and Cryoin, were forced to halt their operations. The two companies together make up almost half of the global neon production, according to Reuters.

TechNode looks at China’s rare gas industry and how it might influence the country’s reaction to the rising rare gas prices.

Rare gas: veins of semiconductor

Rare gasses like neon play a vital part in the semiconductor manufacturing process. Neon gas is the main gas used in excimer laser, a production device used in the chip-making process called photolithography, which uses lasers to “print” circuits onto silicon wafers, the foundation of a semiconductor.

Rare gasses, when energized, emit light, which makes them essential in electronic lumination units. Rare gas mixtures are also used as filling materials to produce lasers, with such devices needed to be replenished routinely. And neon discharges are the most efficient of all rare gasses in producing visible light.

Credit: TechNode/Ward Zhou

Rare gasses or noble gasses are so named because they are rare compared to other elements. Helium, neon, argon, krypton, and xenon comprise these rare gasses listed in the rightmost column of the periodic table of the elements. These elements cause almost no chemical reaction with others, and, for this reason, are regularly used as shielding gasses in industrial production.

How surging market price for rare gasses has affected China

The price of neon has risen more than 10 times since the Russia-Ukraine war, while krypton price rose more than 44% since mid-February.

Ren Lu, an industrial gas expert, told the state media Global Times in mid-February that China has achieved a breakthrough in rare gas productions, and the country can now purify rare gas. Ren added that the Russia-Ukraine war would only lead to a short-term price rise.

Rare gasses like neon, krypton, and xenon are also a side product of the steel industry. Being a top global steel producer, China can expand its rare gas production to fill in gaps that Ukrainian producers have left.

China produced 1.06 billion tons of raw steel in 2020, ranking first worldwide, 10 times the amount produced by India, the second-largest steel producer in the world. Russia ranked fifth place, with raw steel production of 71.6 million tons.

On Feb. 17, Chinese gas company Yingde Gases announced a plan to expand its xenon and krypton production, while the Hangzhou Oxygen plant group stated that its new xenon and krypton production devices will be used later this year.

The local market and major players in China’s rare gas industry

China doesn’t provide a detailed breakdown of its rare gas industry, but a look at China’s electronic gas industry offers clues. Electronic gas is a category that looks at gases used in the production of electronics, consisting of high purity rare gasses and other compound gasses.

China’s production of gasses used for electronic production grew 23% year-on-year in 2021, reaching a market size of RMB 21.6 billion. 62% of China’s electronic gas is used to produce semiconductors, of which 43% are used in integrated circuits, and the rest goes to make photovoltaic and LED circuits, according to Yidu Data.

The country’s electronic gas market is also highly concentrated and controlled by foreign companies, with the top five firms taking an 85% share of the entire market in 2020. They are US-based Airproducts, US-based Praxair, France-based Airliquide, Japan-based Taiyo Nippon Sanso, and German-based Linde.

There are four main electronic gas producers in China: Huate Gas, Jinhong Gas, Nata Opto-electronic Material, and Yoke Technology. Huate Gas provides neon to ASML, the global lithography giant from the Netherlands. Jinhong Gas is capable of producing Xenon, as noted on its official website. Jinhong will start supplying electronic gas to China’s top chipmaker Semiconductor Manufacturing International Corporation in April. However, these four companies only accounted for a tiny fraction of the market share, accounting for only 6.27% of China’s total special gas supply. Special gas is a broader category that includes electronic gas, which includes rare gas.

In addition, Kaimeite Gasses, a neon gas supplier based in the central Chinese province of Hunan, announced last week that they are in talks with ASML and expediting the process.

Post time: Nov-19-2023